Identity theft is on the rise in Canada, with alarming statistics to back it up. A TransUnion Canada study shows nearly half of Canadians have been targeted by fraud, and digital fraud attempts jumped by 40% in early 2023 alone. Over the past decade, identity theft has surged 14%, costing Canadians a staggering $283.5 million in 2023, according to the Canadian Anti-Fraud Centre (CAFC). Yet, many cases remain unreported.

What Is Identity Theft Protection?

Identity theft coverage is a valuable yet often overlooked addition to home insurance policies. Many insurers offer this protection, which can help cover expenses related to fraud, such as legal fees or lost wages. While opinions vary on its necessity, the peace of mind it offers can be invaluable. Your insurance broker can help you determine if this coverage is right for your needs and budget.

If You’re a Victim of Identity Fraud

If you suspect your identity has been stolen, act quickly:

- File a police report with your local authorities.

- Notify your bank, credit card company, and insurance broker immediately.

- Contact the credit bureaus to place a fraud alert on your file:

- Equifax Canada: 1-800-465-7166

- TransUnion Canada: 1-877-525-3823

- Report the fraud to the Canadian Anti-Fraud Centre.

5 Tips to Prevent Identity Fraud

1.Protect Personal Documents

Keep sensitive documents secure and avoid sharing personal information in public or online unless absolutely necessary.

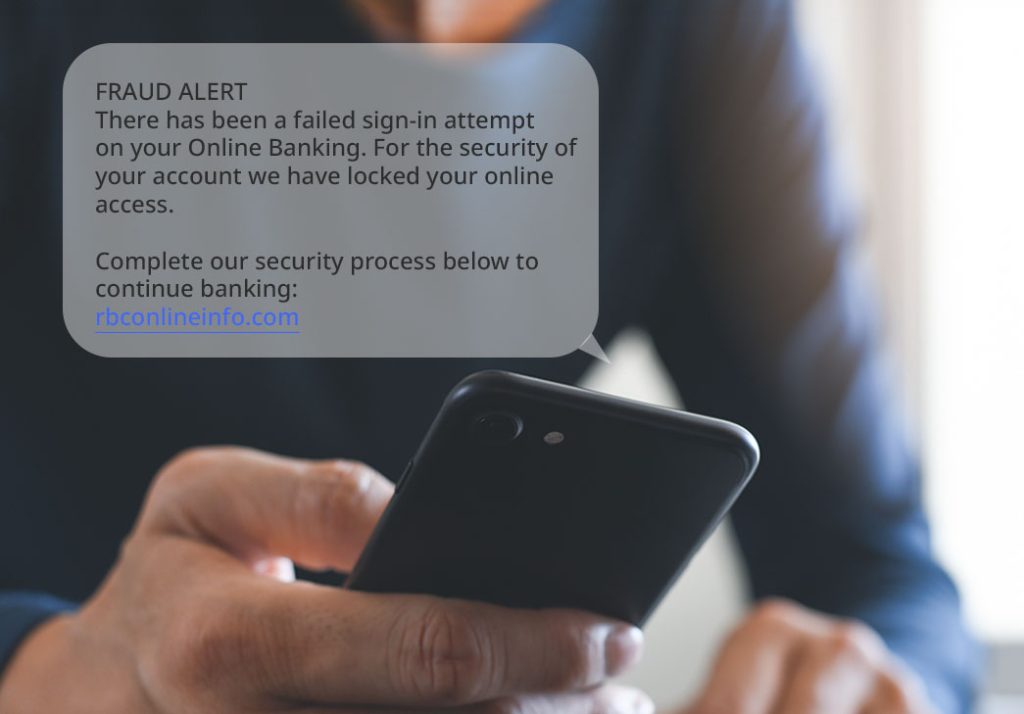

2. Stay Safe Online

Avoid public Wi-Fi for financial transactions and be cautious of phishing scams. Fraudsters often use fake emails and websites to steal personal information.

3. Watch Your Finances

Regularly review your bank statements, credit card activity, and credit reports for suspicious transactions. Credit monitoring services can provide an extra layer of security.

4. Verify Unsolicited Contacts

Don’t give out personal details to unknown callers, emails, or texts. Confirm the legitimacy of the contact before sharing any information.

5. Consider Identity Theft Insurance

Talk to your broker about adding identity theft coverage to your home insurance. It can provide financial support and resources to recover if your identity is compromised.

Protect What Matters Most

Identity theft can be costly, but taking proactive steps can minimize your risk. For personalized advice on adding identity theft protection to your insurance plan, reach out to us today!